Over the last 12 months, North America’s relationship with igaming has evolved with more states opening the borders to online gaming and the emergence of regulated markets.

Yet, with the increase in regulated markets, question marks have arisen regarding slot innovation being halted in the US due to regulated markets being formed.

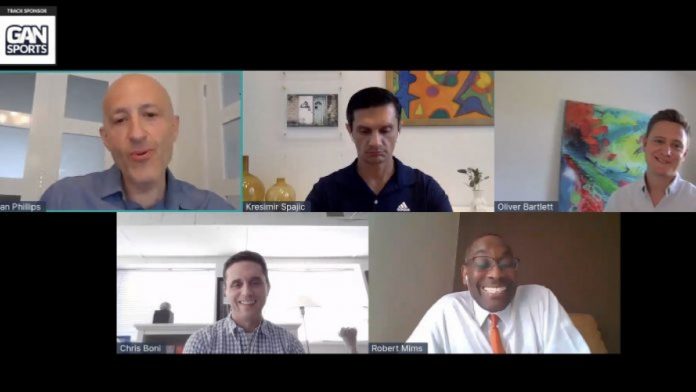

As part of a panel entitled ‘From gaming floor to mobile slots – harnessing the omnichannel opportunity’, on a track sponsored by GAN Sports, US experts delving into slot innovation within the US questioned if there is a new omnichannel player emerging due to a period where land-based players having been forced to adopt online gaming.

Oliver Bartlett, Director of Gaming at BetMGM, emphasized that now is the time for ‘quality over quantity’. He noted: “For the past three years, if you go on any slot providers website there will be an Irish game, an Egyptian game, a space game, and I think we need to move away from that.

“The new market is so judgemental so quickly and if you’re not engaging with players, they are not going to play with you.”

Adding to Bartlett’s point, Kresimir Spajic, former SVP and MD, Online Gaming and Sports Betting at the Hard Rock International, claimed that innovation within the US market, in regards to slots, is limited due to regulation and costs of market entry.

He explained: “One of the big things here will be consolidation, which we’ve already seen with Evolution. Yet I think the key thing will be that innovation doesn’t come from the giants, it comes from the small guys that are very creative and have great ideas.

“We need to be able to have those entities in the US. Currently we don’t have as the market is too small, the barriers are too high to enter and we are missing out on this.”

Away from content, Robert Mims, Pit Manager at Sugarhouse casino, stressed that innovation, in his eyes, comes from partnerships. Providing an example of a recently released advert with the NBA and the Fast and Furious film franchise, Mims noted that those partnerships would not have merged five years ago.

“We’re very primary in our marketing, it generally just affects the casino and the hotel,” said Mims. “We should expand out of that. Find partners that have our same theme and message that involves entertainment as well as gaming and see how those promotions could work.”

On Mims’ point, panel Moderator Dan Phillips, CEO of NEL Advisory, reminisced of his Playtech days where they would gain licences from Marvel and DC Comics, which he noted performed really well, yet came with a premium attached to them due to the brand owners wanting to make ‘a big chunk of change’.

He claimed operators used to ‘swallow’ the alterations yet would always look to cross-sell its customer base with the cheaper products, which could leave the studio with a ‘big bill’ to pay. Firing a question back to Mims, Phillps asked what balance was between operator and studio for branded IP content.

Mims responded: “I think it should be 10 per cent (commission) because that way we can both make money. If you’re making it a higher percentage then you’re going to skew too high paying out and you will be asking for a high demand on that product. A lot of people will have to be playing that product for you to make money in-house or online. It would not work.

“If there’s a standard fee you want to buy in, it would be mutual for both. That would be 10 per cent and make that across the board, then you can see it coming into play.”

Shifting the conversation back to content, Spajic highlighted that it is a ‘long game’ but the reality is the US have ‘different types of customers’. Spajic pointed out that innovation within slots in the present day is ‘all about the game features’ and ‘engagement’.

“If you talk about innovation and the younger audience, we have to talk about two things,” he continued. “How they engage with the game… is this touch and feel engagement. The second part is how much of a skill you have in the game.

“I will tell you from our experience, the current customer does not really want much skill involved. When there’s too much skill involved, they lose interest. They are there to win.

“A fine balance between winning opportunity, some skill set and how you engage with the game is the future of this industry. We also need to look outside of the industry. If you ask the customer, they are going to give you an answer in what they know.

“The biggest innovation didn’t come from a customer but from creative people in the industry who looked outside and brought ideas in and then adapted for the customers.”

Asked by Phillips on how to balance innovation and customer satisfaction, Chris Boni, VP, Digital Gaming Products at IGT, stated it is a ‘difficult challenge’, yet looked to companies like YouTube for inspiration.

He remarked: “One of the things that can drive the industry forward is to continue ways to lower the cost of content creation, iteration and distribution.

“If you look at other industries, like YouTube, you’ve got an ecosystem there of content creators who have raised the bar in quality and monetization with a community involved and if we can trend to something like that, the more content we can create, the faster we can iterate, the faster we can get feedback, the more we can use automation to support that process I think we can get to a more better place as an industry and a higher quality product.”

Pressed on how the industry can move forward with Boni’s suggestion, Bartlett claimed the days of static web pages where all the games which players prefer are in order whilst declaring it’s ‘our job and duty’ to present new and engaging content to players who don’t know what they are searching for.

“Sure, if I wanted to play Cleopatra for the rest of my days I can, I can find that. But presentation of content is the only way we’re going to measure success.

“I want to address something that I am concerned about with innovation in the US. There’s two factors we need to work on as an industry. The inevitable market consolidation, people are buying up everyone at the moment which could be seen as a concern but also the barrier for these smaller content providers to enter the US market is so high at the moment.

“I’m not sure we as an industry, certainly in the US, encourage that entry and for the content to be produced. Having those young and hungry companies under them like to fire on everyone and is a benefit for the entire industry.”